An Inconvenient Truth

This is the European Year for Development. In Ireland there are a variety of events being organised by various community and voluntary organisations and development charities, and later this year all countries are being asked to set ‘Sustainable Development’ goals – not just for the developing world, but also for richer countries such as Ireland.

I was asked to speak at a recent Christian Aid seminar which looked at Human Rights and the impact of Tax and Fiscal Policy on those rights, to tell the story of the impact of austerity in Ireland from an SVP perspective. While the downturn meant reductions in living standards for many, austerity measures further compounded the cuts to public services and eligibility to them, and increases in deprivation and poverty – particularly among lone parents and children.

SVP doesn’t say much about tax given our broad church of members – with a corresponding breadth of views. So while not having a mandate to question the official Irish Government headline rate of 12 .5% corporation tax, I do believe it was appropriate and indeed necessary to point to the inherent injustice of companies who design mechanisms so that the effective tax they pay is well below the official headline rate of 12 .5%.

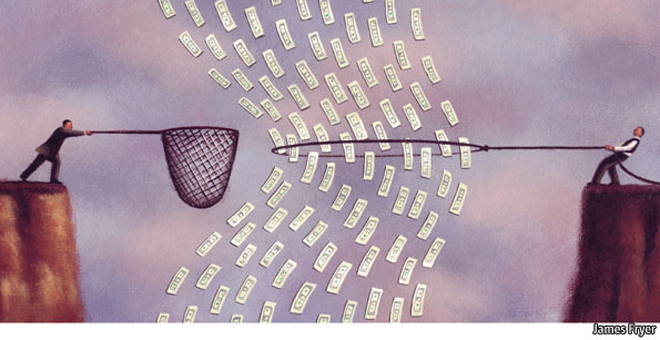

There are strong forces and factors at play, at home and abroad, pushing to minimise the effective tax rates that companies pay. I accept that there is a point beyond which companies will not view the rate as profitable, and where foreign investment will not locate here or will in fact leave, but we are nowhere near that level in Ireland.

On the revenue side however, we have been suffering from significant cuts in tax take in a number of areas since 2007, partly due to the economic collapse that occurred, but also due to Government tax and fiscal policy. Our experience on the ground shows that people on the lowest income and the least powerful have borne the brunt of the public revenue collapse - despite the dominant narrative of the so-called ‘squeezed middle’. While certain Government measures over the last four years have broadened the tax base, which is welcome, at the very same time companies at home and abroad have engineered ways of shrinking the effective tax they pay – whether in Nigeria or Ireland. To what extent have tax authorities and the legal and accounting communities here contributed to reducing the effective levels of tax paid?

Less tax paid by a company resident here means less resources in Ireland for things like social housing programmes, child income supports, energy retrofitting of homes and early childhood care and education. And what needs has SVP seen on the ground and responded to during the austerity years? Homeless families in emergency accommodation and hotels; recent substantial increases in child poverty; an aging, energy inefficient housing stock and the increased inability of many to heat their homes; and a lack of access to quality, affordable childcare for parents trying to move from welfare to work.

Tax avoided means the denial of a child or family from the services they vitally need. While some tax avoidance may not be a crime, it is certainly not without its victims. The 2015 European Year for Development is not about aid – it’s about sustainable development. Development requires tax revenues to sustain the public good – however inconvenient that truth might be for corporations, tax authorities or certain professions.